Growth Warrior released the 2019 Warrior Report: State of the Underdog, which examines the current state of the investment landscape. The comprehensive analysis aims to identify solutions for the challenges holding back under-represented entrepreneurs, referred to as Underdogs.

“Our study reveals compelling insights into the state of minority representation in VC and Private Equity funding. Despite growth in minority-owned and led ventures, relative investment remains low,” Promise Phelon, CEO of Growth Warrior Capital said. “Our objective is to tell an optimistic story, inform underdogs, and appeal to investors so they work harder to access this community of entrepreneurs.”

Women and People of Color Are Founding More Companies

Four out of every 10 businesses in the U.S. are owned or co-owned by women. Furthermore, since 2007, we’ve seen a 58 percent increase in women-owned businesses. In 2017, there were roughly 1,821 net new companies launched by women, and women of color launched 64 percent of those businesses.

More Investors and Organizations are Supporting LGBTQ Founders

While the total percentage of venture capitalists and angel investors is unknown, many are gaining greater influence within the industry, like Arlan Hamilton of Backstage Capital, David Blumberg of Blumberg Capital, and many others. Likewise, new networks are launching to connect LGBTQ entrepreneurs to investors, including GAINGELS, whose portfolio includes companies such as Hubble, Andie, Perch, ThinkCERCA, and has affiliations with techstars, ALPHA Venture Partners, Sapphire Ventures, and more.

More People of Color are Becoming Venture Capitalists in Existing or New Firms

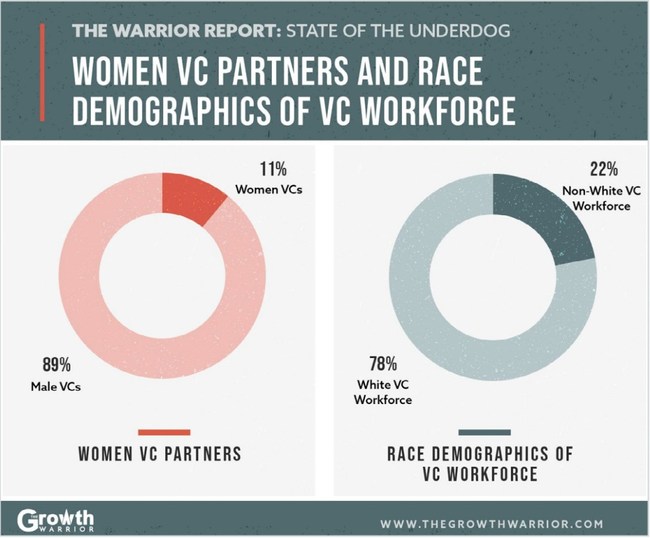

The percentage of venture capitalists of color is drastically low. Only 22 percent of the entire venture capital workforce identifies as non-white — which includes investment partners, principals who may become investors, other professionals and administrative staff. What’s promising, however, is the increase in investment power for VCs of color. In 2018, roughly $370 million was raised or planned by African American venture capitalists. Additionally, more venture capitalists of color are circumnavigating the traditional firms and launching their own funds, and more organizations are focused specifically on supporting the underdog entrepreneur.

Access and download the full report here: https://thegrowthwarrior.com/state-of-the-underdog-report

About The Growth Warrior

Created by serial CEO and tech investor Promise Phelon in 2018, The Growth Warrior is a mentoring company with a focus on driving underdog entrepreneurial success. The Growth Warrior is a subsidiary of Growth Warrior Capital, a fund that builds, invests, and acquires high potential internet-based companies in lucrative markets, disrupting the status quo. The shared vision is to deliver a proven model for accelerated growth, helping entrepreneurs scale their business, get funded and deliver on breakthrough opportunities.

Growth Warrior is building a tribe of like-minded entrepreneurs, seasoned mentors and a network of tech investors, fundamentally changing the investment landscape. The program provides entrepreneurs with access to exclusive interviews and mastermind series with industry-leading CEOs, venture capitalists, bankers and thought leaders. Resources and tools are published weekly, helping business owners become stronger, clear-minded, and focused on the funding process.

To learn more about the Growth Warrior tribe, visit www.thegrowthwarrior.com.